|

Business support and consulting in Russia. Legal advisors. |

|

|

|

||

Аbout Russia

Business and economics

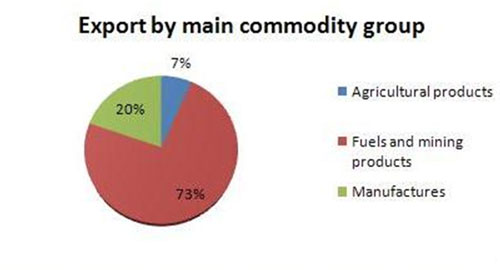

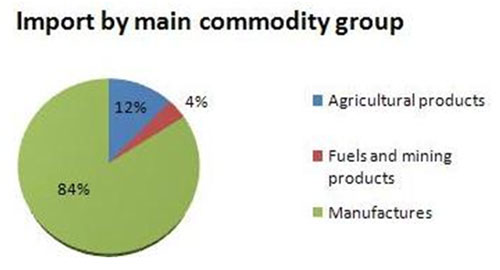

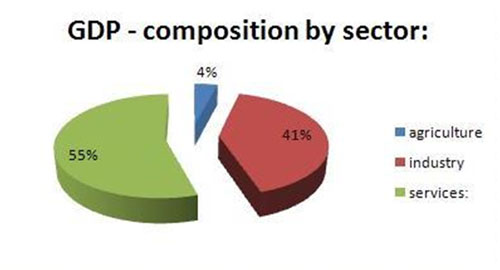

The high

oil prices brought in revenue for Russia

between 2005 and 2008 and continue to do so in light of the North Africa and Middle East crisis of 2011, which is in charge of a very

substantial increase in oil prices. However, the country has yet to tackle the

limited domestic demand and its heavy dependence on foreign import, which

contributed to the contraction of its economy by 7.9% in 2009. The industries

which are particularly attractive such as: mining, construction, aerospace,

research and development, food and beverages, agriculture, logistics, timber

and metal processing. The average salary is still quite low, but in certain

areas, especially in the main cities Moscow

and Saint-Petersburg an immense skilled workforce is available. Last but not

least, Russia

is not a homogeneous country – it has a variety of nationalities, along with

developed and poor areas with different needs. High end, luxury goods will sell

very well in Moscow

and Saint-Petersburg, but would find few customers in other of Russian regions. Investment breakthrough of 2011http://expert.ru/2011/08/25/nvestitsionnyij-proryiv/

According to Federal Statics Bureau of Russia (Rosstat) only within first six months of 2011 there has been invested over 87,7 billions dollars from foreign companies into Russian Economy, which is over 2.9 times more than there had been invested during the same period of time in 2010. It has been already described as an abnormal volume of investments, such inflow has never been registered before. The contribution of direct investments accounts for 7039 million dollars, which is for 30% more, than it was for the first six months of 2010.The amount of portfolio investments has increased for 34,5%, up to 241 million dollars. All other investments have grown 3,3 times higher and account for 80 418 million in the total figuer. The recent economical reports show that there has been accumulated over 315 milliard dollars of foreign capital by to the end of June 2011, indicating the 19,9% growth over the figures of the previous year’s same period. During the first six months of 2011 the amount of foreign cleared off capital constituted 81,7 milliard dollars, which is 2,5 times higher than it was a year before, which means that the foreign investments have accounted 6 milliard dollars. And the total growth of direct and portfolio investments is 30% this year alone. Mostly due to western manufacturing companies readiness to establish their presence on the Russian Market. Additionally, the Russian stock is becoming more and more attractive for foreign investors. The 2011 year’s economical situation for the Russian Market is quite promising yet for another reason, oil prices remain high, and though the global recession is no myth and the oil prices may considerably roll back, the Russian Budget for 2011 year was calculated to withstand the oil price of 80 dollars for barrel, so it has a high degree of safety still. There is also a significant capital repatriation, mostly made by Russian companies registered in Cyprus, this fact also gives some optimism. All analysts predict a bright future for Russia in terms of foreign capitalization generally thanks to its vast mineral resources and enormous territory.

Mineral deposits

Mining was the country's major industry in 2002, and Russia was the largest exporter of palladium and nickel (20% of world output), and ranked second in the production of aluminum and platinum-group metals, third in potash, sixth in gold, and seventh in mine copper. Russia also produced a large percentage of the CIS's bauxite, coal, cobalt, diamond, lead, mica, natural gas, oil, tin, zinc, and many other metals, industrial minerals, and mineral fuels. Enterprises considered part of the mineral and raw-material complex contributed 70% of the budget revenues derived from exports; petroleum, petroleum products, and natural gas were Russia's leading export commodities in 2002; metals and chemicals also were leading export commodities. With up to 10 percent of the world’s known oil reserves, Russia pumped on average 9.4 million barrels a day and exported around 7 million last year--second only to Saudi Arabia and occasionally outstripping the desert kingdom in monthly production. In the past six years, the high prices for crude oil have added at least 15 percent to the country’s gross domestic product, brought billions of dollars to the treasury, wich boosted personal incomes by almost one-third, and significantly enhanced Russia’s position in the world. The shelves of the Far East and Eastern Siberia have especially good prospects for large-scale and long-term developments of the offshore oil and gas fields. The promising areas in these regions (excluding Sakhalin and its shelf) are estimated at about 1.5 million square kilometers. Potential recoverable resources are estimated at billions of tons of conventional fuel. These reserves are concentrated mostly in the Sea of Okhotsk and the Bering, Chukchi, and East-Siberian Seas. Here, more than 20 oil- and gas-bearing and potentially oil- and gas-bearing basins of different geotectonic nature have been discovered. Despite decreased metal output compared with the Soviet period (e.g., 20% as much tin), Russia was producing more aluminum, lead, and zinc in 2000 than during the Soviet era. Ten percent of the technology employed in the nonferrous mining and metallurgy sector was rated as world class, labor productivity was one-third below that of advanced industrialized countries, and energy expenditures were 20%–30% higher. Another problem was that the resource base for metallurgical enterprises was not competitive in terms of quality, with the exception of antimony, copper, nickel, and molybdenum. More than one-half of industrial mineral output was exported, depriving the domestic sector of so badly needed supplies, especially barite, bentonite, crystalline graphite, and kaolin. So far Russia has not been successful in attracting foreign investment for developing its mineral deposits, because of high and unpredictable taxes, not quite reliable legal system, not always secure licensing, inequity in the treatment of domestic and foreign partners, a retrograde banking system, and the inability to directly export commodities. The most troubling areas are transportation, taxation, domestic consumption, investments, and especially ownership. In the end, all of these issues are linked to the ideological change in economic policy over the past four years and thus are unlikely to be addressed effectively until the country alters its political direction. Though there is little doubt that Russia will remain one of the world’s leading exporters for many years. Unless arrested or reversed, several structural tendencies may significantly jeopardize Russia’s ability to meet the world’s rapidly growing demand for oil.

The business overview

All recent political changes, government reforms, a stable economy, vast natural resources and a large population have all led to Russia seeing enormous advances in their foreign trade links. However, Churchill's description of the country as a 'riddle wrapped in a mystery inside an enigma' still very much holds true for outsiders looking in. Gaining some basic insight into the Russian mentality, culture and etiquette are key for anyone doing business in Russia. Russia offers enormous investment opportunities in various industries, both on the domestic market and for companies from outside the country. However, this is not a market which a Western entrepreneur will find familiar at first glance, and the 19th century saying that “one cannot understand Russia, Russia is something which one should believe in” is still topical. Despite the fact that the Soviet era is already a distant memory, the country’s economy is still controlled to a vast extent either directly by the state or through companies which are dependent on the state and which enjoy various privileges. Simultaneously, sensitive areas such as defence and mining are either closed to non-Russian investors or are available only as minority stake in a joint venture, with a controlling stake held by the Russian partner. The well known cases of TNK/BP and Yukos have not helped to encourage foreign investors. Nevertheless, Russia offers a unique investment opportunity, and one must obey certain operational rules on its market as additional expenditures of market entry. The complications include a still substantial amount of bureaucracy, a poor developed infrastructure, rigorous regulations, local competition and the lingering shadow economy. It is generally advisable to enter by means of a joint venture or the takeover of a Russian company which knows the local conditions and can provide effective trouble-shooting expertise. This country is the largest twentieth-century example of why capitalism talks and communism walks. After eight decades of rigid Red rule, the bear was finally let out of the cage. It is still a mere infant in capitalist years, and if anyone has taken the phrase 'free market' too literally it's Russia. There are few barriers, few restrictions and few lines drawn in the corporate sand. Exploitation has been rife at times, and there are instances of criminality at the highest levels of government and business. Corruption is no secret, though, so it is probably best we get it out of the way now. Political transitions are not mellifluous by nature, and Russia suffered. Yet something has risen from the ashes: the phoenix of a new Kremlin, a new opportunity. Success breeds in the most unlikely of situations, and like most countries that have recently found capitalism, times are good for investment. Russia is currently flirting with top-ten economic status, adamantly poised in eleventh place. It is the biggest and most attractive emerging market, and its advantages read longer than Tolstoy. Frankly, there has never been a better time to be a part of Russia's new chapter. Stifling red tape might be tougher to plough through than the Soviet snow, but its no better or worse than other emerging markets, and even some developed ones. If we're discussing the bureaucratic barometer, just look at Italy and we'll say no more. Things ultimately get done. Russia excels in building these areas of economics: special free zones, concession agreements, independent investments funds and development banks. It also maintains a progressive approach to economic advancement, focused primarily on stabilization and eclecticism. In terms of main Russian disaster, corruption,

its perception in 2010 as measured by Transparency International stood at 2.1

(the CPI – the Corruption Perception Index), which left Russia in 154th

place among the 180 countries surveyed. Russia’s CPI has been falling in

recent years, at a time at which many countries have been making progress in

this arena. The country is regarded as one of the most corrupt major economies.

Corruption is Russia’s

most serious economic problem, and it is difficult to tackle now that it has

become endemic, despite some decisive attempts by the government to curb it. Social environment

Technological environment

Russia

has a well-developed and, in some areas, outstanding, research and development

base. This applies in particular to industries developed during the reign of Soviets:

heavy industry, aviation, aerospace, nuclear energy, chemical industry, etc.

Some of these are closed to foreign companies for security reasons. However,

these restrictions are sometimes mitigated if a Russian partner company is

involved in the project.

Infrastructure

The currencyThe home currency in Russia is ruble (or rouble).

Political structutre

Climate and weatherThe climate in Russia can vary due to its vast size. Continental climate dominates in the central part of the country, and in the south, it is subject to Arctic and Atlantic influences, as a result of mountains obstructing the flow of warm air masses from the north and west plain and Indian Ocean. There are only two distinct seasons - summer and winter. Spring and autumn are usually brief periods between the changing temperatures of summer and winter. The coldest month is January (on the shores of the seas it is February) and the warmest is usually July. Overall the weather, due to global warming, is becoming more and more unpredictable. Labour and workforceIn 2010 the unemployment rate in Russia reached 6% , which is an increase in comparison with 4% in 2009, though in 2008 it was 6.2% . However, we believe that the available statistics as usually do not reflect the real situation and this figuer is actually higher. If there is one word associated with emerging markets, it's “booming”, and it’s just the right word to describe today’s Russian economy. The challenges of market entry shouldn't be underestimated, but the Great Bear is an eastern promise of opportunity. If you want to be part of the great emergence, then it is time to give a strong consideration to the first step onto this vibrant market. |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| © 2011 Technologia ONE All rights reserved. |

tel: +1 919-883-9396 |